Top 5 Losses Homeowners Insurance Will Not Cover

Home insurance is designed to cover a broad range of perils that are associated with owning or even renting a home. A great example of a peril would be theft or a fire or any event that can cause damage to your home. Home insurance in North Carolina is not required by law, but if your home is mortgaged then your lender may require you to purchase homeowners insurance. If you rent, your landlord may suggest that you purchase renters insurance to cover your personal belongings.

Home Insurance is know for protecting you against liability for accidents that damage your home or injure people. So if you have a good idea of what is covered, then it’s best to also learn what is not covered. The top five major losses that homeowners insurance will not cover are listed below.

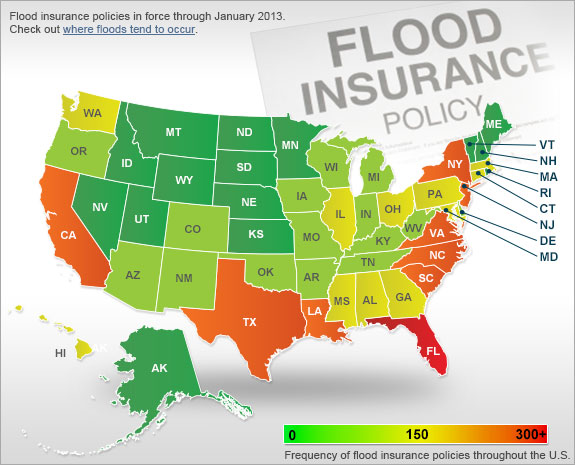

- Floods [map]

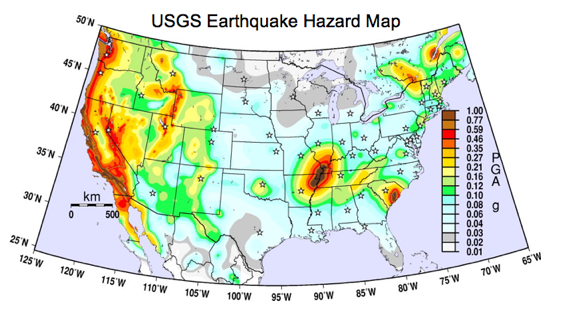

- Earthquakes [map]

- Mudslides

- Mudflows

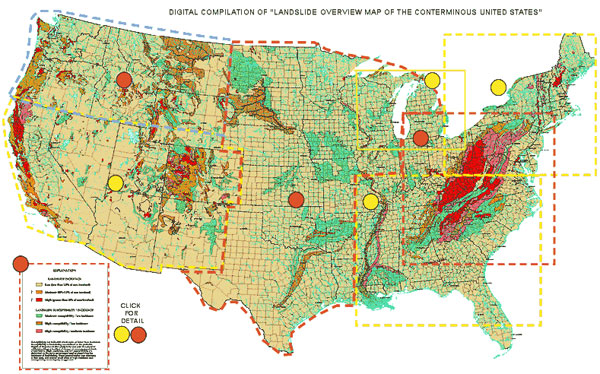

- Landslides [map]

It’s extremely important that you contact your agent to discuss your options for purchasing additional coverage for these losses.

Flood Zone Map

The map below shows a layout of flood insurance policies throughout the United States. Major flood insurance areas are in California, Texas, Louisiana, Florida, South Carolina, North Carolina, Virginia and New York.

Earthquakes Zone Map

The U.S. Geological Survey Hazard Earthquake map shows major earthquakes on the west coast in California, Oregon and Washington. The map also shows some earthquake activity in South Carolina, west of Tennessee, in the north part of Arkansas, and the very southern tip of Ohio and Indiana.

Landslide Zone Map

The digital compilation of landslides within the United States, mainly in the west coast, mid-west and inner states of the east coast.